Cha-Ching! A Single Paycheck Is Probably Not Enough

Case for and against having multiple streams of income

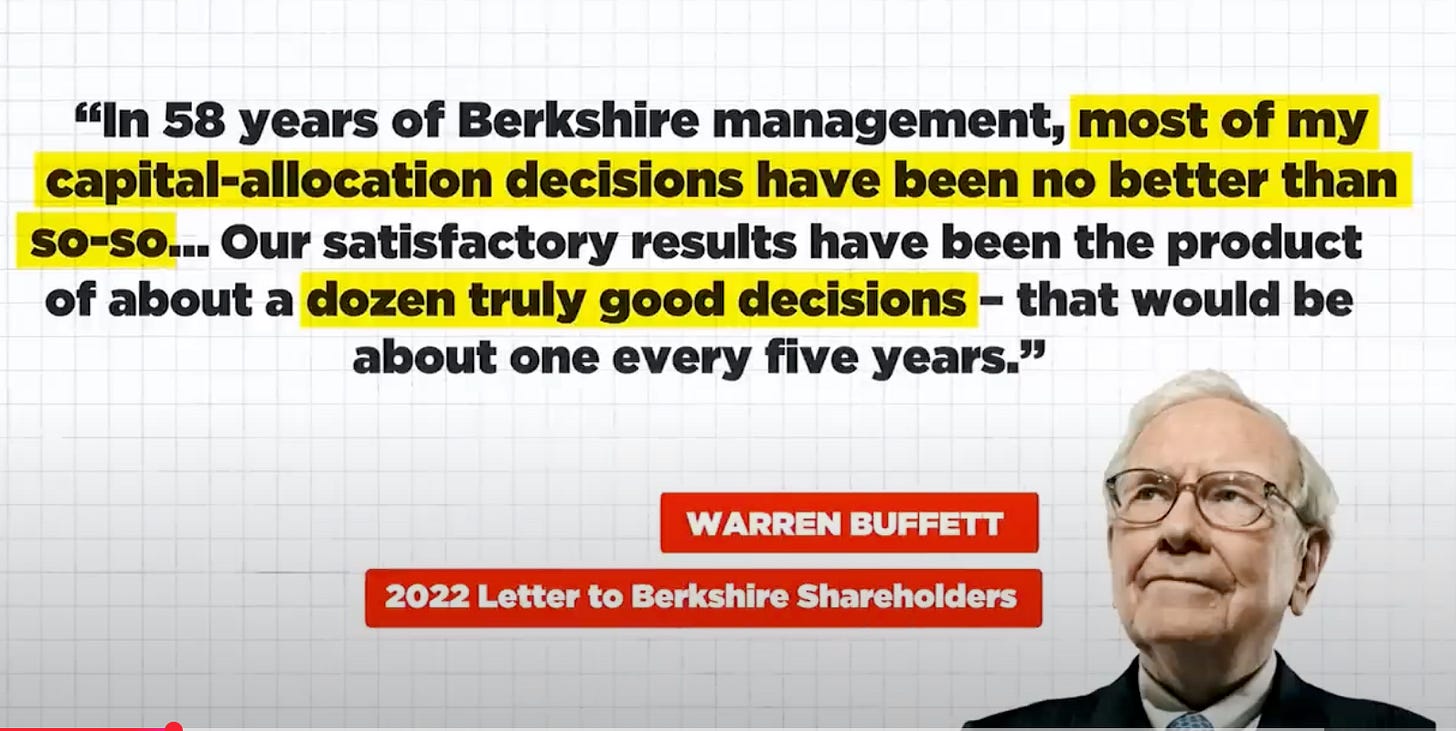

In his 2022 annual letter, Warren Buffett noted that most of his capital allocation decisions at Berkshire Hathaway have been unremarkable. He attributes Berkshire’s impressive results to about a dozen key decisions made over several decades—roughly one significant choice every five years. This suggests a success rate of only about 4%. Over the years, Berkshire has acquired entire businesses, such as See’s Candies and BNSF Railway, and invested in publicly traded companies like American Express and The Washington Post. Originally a textile manufacturer, Berkshire evolved into an insurance powerhouse and then diversified into various unrelated sectors. Buffett was never afraid to move beyond his core business, recognizing that diversification could reduce risk and build resilience.

Recently, a tweet triggered a discussion between my business partner and me whether an average joe should focus on creating multiple streams of income through active work and / or businesses.

To help me think through this question, I turned to a concept In the book “Maxims for thinking analytically”. The first maxim states that when you are having trouble getting your thinking straight, go to an extreme case. It goes on to state that the maxim is helpful in two cases -

To understand a concept, problem, or idea better, or

To assess the best-case or worst-case consquences of a decision you are struggling to make.

By pushing a question to an extreme, new patterns can emerge that can help us evaluate the best-case and the worst-case consequences of the problem we are facing.

The second use case would perfectly well in the problem we have to tackle - “Should one create multiple sources of income for themselves?”

Using the maxim above, the two extremes could be as follows -

I am someone who is really good at what I do. I can use my skills to increase my income exponentially over time. My skills will continue to remain valuable after a couple of decades. I do not need to diversify my sources of income.

I am someone who is average at what I do. No matter how much I work at improving myself, growth in my income will be in line with inflation. My skills could be taken over by AI over time. I need to diversify my sources of income.

If we apply the same maxim to Berkshire Hathaway, Buffet probably erred on the side on caution and took the approach of the average guy. The textile business would not have made enough money for it to be a $500 billion enterprise. He understood that in order to create resilience in his business, he needed to diversify and create multiple different sources of cashflows for Berkshire that are unrelated to each other. Buffet reduced dependencies that make systems fragile.

Individuals should use these strategies in their personal lives. Diversification is an error tolerant strategy that can survive our own mistakes, bad luck, and our inability to see the future. The future is so “intrinsically uncertain” that as individuals we must focus on avoiding a future where we struggle to make ends meet.

investors should focus heavily on avoiding permanent losses and building “a portfolio that can endure various states of the world.

The world is filled with average and below average people. It is up to the average to take charge of their lives and their finances.

Some ideas to create more resilience -

It is always better to err on the side of caution.

Insure your health and life first; think later.

Start investing early.

Encourage everyone in family to earn and take charge of their own expenses.

Figure if you like your job. If you do, work towards being the best in your organisation. Become irreplaceable.

If you do not love what you do, go back to the drawing board and see what do you enjoy and figure if you can make a business from it.

Remove fragility from finances - credit card debt, personal loans, etc.

Create optionality - Do not lock yourself into obligations that could limit your choices when circumstances change.

Pursue whole-life balance - success every where - health, wealth, and relationships.

Thanks for reading. Kindly excuse errors, if any. The data gathered is off the internet from various sources and could be prone to errors. Please do highlight better publicly sources.

💲 Let Us Help You With Your Finances

📚 My favourite books and gadgets

𝕏 Twitter

▶️ Youtube

📝 Sign up for my paid newsletter focused on credit cards and rewards